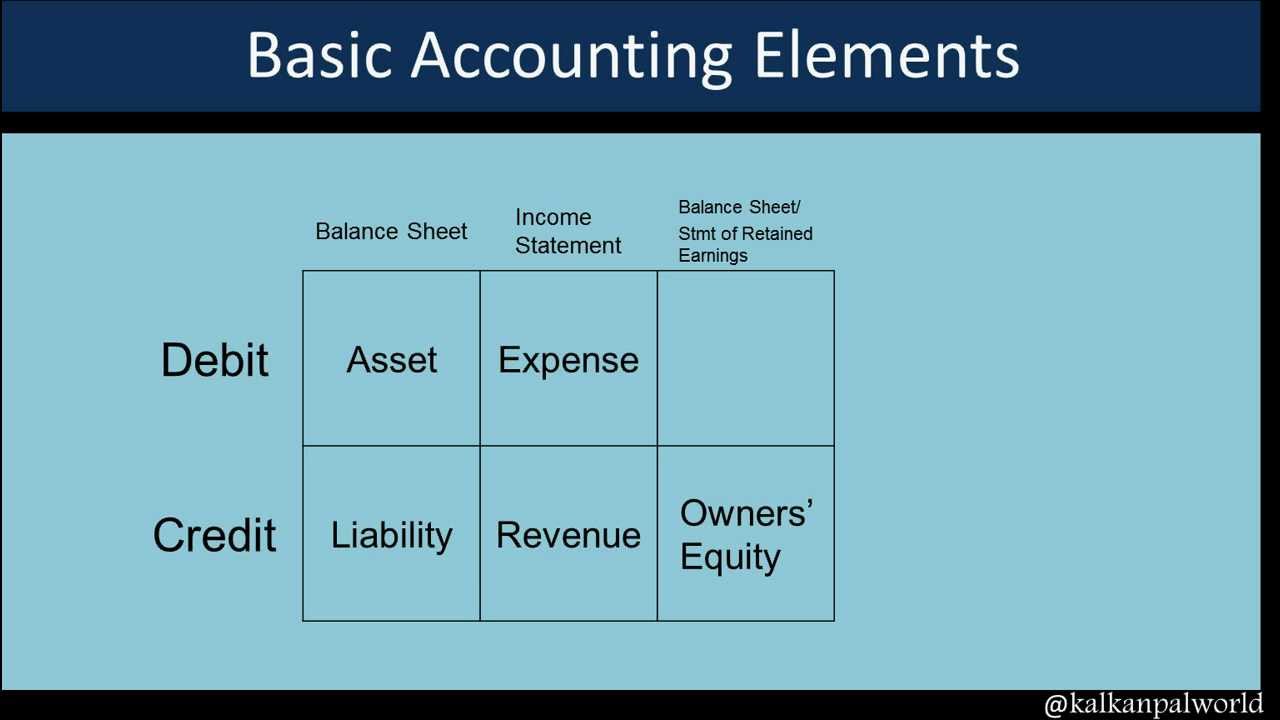

We know that if assets increase, either liabilities or equity must as well. Selling something on credit increases your accounts receivable - an asset account - since someone now owes you money.īut what about that second line? You must credit something to balance the transaction. Here’s what the incomplete journal entry looks like: Imagine you sell $1,000 worth of services on credit to a customer. This makes more sense if we look at an example. In a corporation, revenues are closed out and transferred to the retained earnings account at the end of an accounting period. This is because revenues increase equity. Debits reduce revenue, while credits increase it. Revenueĭebits increase assets, so it must increase revenue, right? Thus, you credit that equity account (which increases equity) to balance out the transaction. However, you must also record the equity you issued to your friend to balance the accounting equation. Recall that cash is an asset, and debits increase assets, so you debit cash. Your business receives cash from your friend. Say you persuade a friend to invest $2,000 into your burgeoning new business. EquityĮquity works like liabilities - debits make equity go down, and credits make it go up. You’ve reduced both a liability and an asset, keeping the accounting equation balanced. Meanwhile, you’re sending money to your supplier, so you credit cash to reduce the cash account. Thus, you debit accounts payable to “clear it out”. Once you pay your $1,000 invoice, you no longer owe money. Now, say you pay your $1,000 invoice 15 days later. You’re increasing your accounts payable by buying on credit since you now owe money. Accounts payable is a liability that represents money you owe to suppliers and vendors. To keep the accounting equation in balance, you have to increase a liability. Say you purchased $1,000 of inventory on credit. Debits decrease them, while credits increase them. Liabilities work in the exact opposite fashion as assets. The accounting equation stays in balance because the increase and decrease in assets cancel each other out. Meanwhile, we paid out cash, so we’d credit the cash account. We received inventory, so we debit the inventory account, increasing its value. Cash, of course, is an asset - and so is inventory.Ĭash is flowing out of your hands in exchange for receipt of this inventory. Imagine you purchase $1,000 of inventory from a supplier with cash. How Debits and Credits Affect Each Type of Account Assetsĭebits increase assets, whereas credits decrease them. It also helps to know the accounting equation: Assets = Liabilities + Owner’s Equity. We’ll cover these transactions in more detail in the next section. Here’s a quick table showing how debits and credits affect each type of account. In an accounting ledger, you record debits on the left and credits on the right. Multiple accounts may be debited and/or credited in the same journal entry, too. Thus, every financial transaction consists of a debit portion and a credit portion to balance your books. One will go up, and the other will go down. Creating a new invoice would increase your accounts receivable, whereas receiving payment on an invoice would reduce it.Īny transaction your business makes affects at least two buckets.

Think of these like buckets containing defined amounts of money.įor example, your accounts receivable might be one bucket (an asset). Well, the double-entry accounting system used by nearly every business in existence breaks your firm down into individual accounts. Credits, on the other hand, show money leaving an account. In general, a debit represents money coming into one of your financial accounts. What Are Debits and Credits?ĭebits and credits are simply types of accounting entries used to record changes in financial accounts that result from business transactions. You’ll learn what they are (and the differences between them) and how they affect your firm’s financial accounts.

ACCOUNTING ACCOUNT TYPES DEBIT CREDIT SOFTWARE

It helps immensely to understand them, even if your software or bookkeeper handles your bookkeeping.īelow is a simple guide to debits and credits. Yet, debits and credits are foundational to doing your accounting in the first place. In accounting, “debits” and “credits” have slightly different meanings - and this confuses plenty of people who aren’t too familiar with accounting jargon. Most people know that debit cards let you spend out of a checking account, while credit cards let you borrow money to pay back every month. Your Simple Guide to Debits and Credits + Examples Tools you need to consider for auto invoicing (1).

ACCOUNTING ACCOUNT TYPES DEBIT CREDIT HOW TO

0 kommentar(er)

0 kommentar(er)